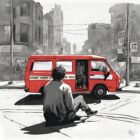

Homelessness

Homeless Outreach Declines With Street Team’s Shifting Priorities, Staffing Woes

Street outreach by San Francisco’s premier team for helping people living on the streets has fallen for years and could continue dropping.

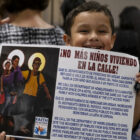

Years-long staffing woes and shifting work priorities have driven the decline, leaving the team less time for their core mission: building trust with unhoused people and helping them access social services and housing. Homelessness advocates approved of the team’s new efforts to bring people indoors, but worried that officials’ political motives might be influencing these changes.