Environment

Berkeley scientists’ next green energy alternative: stomach bug to biofuel

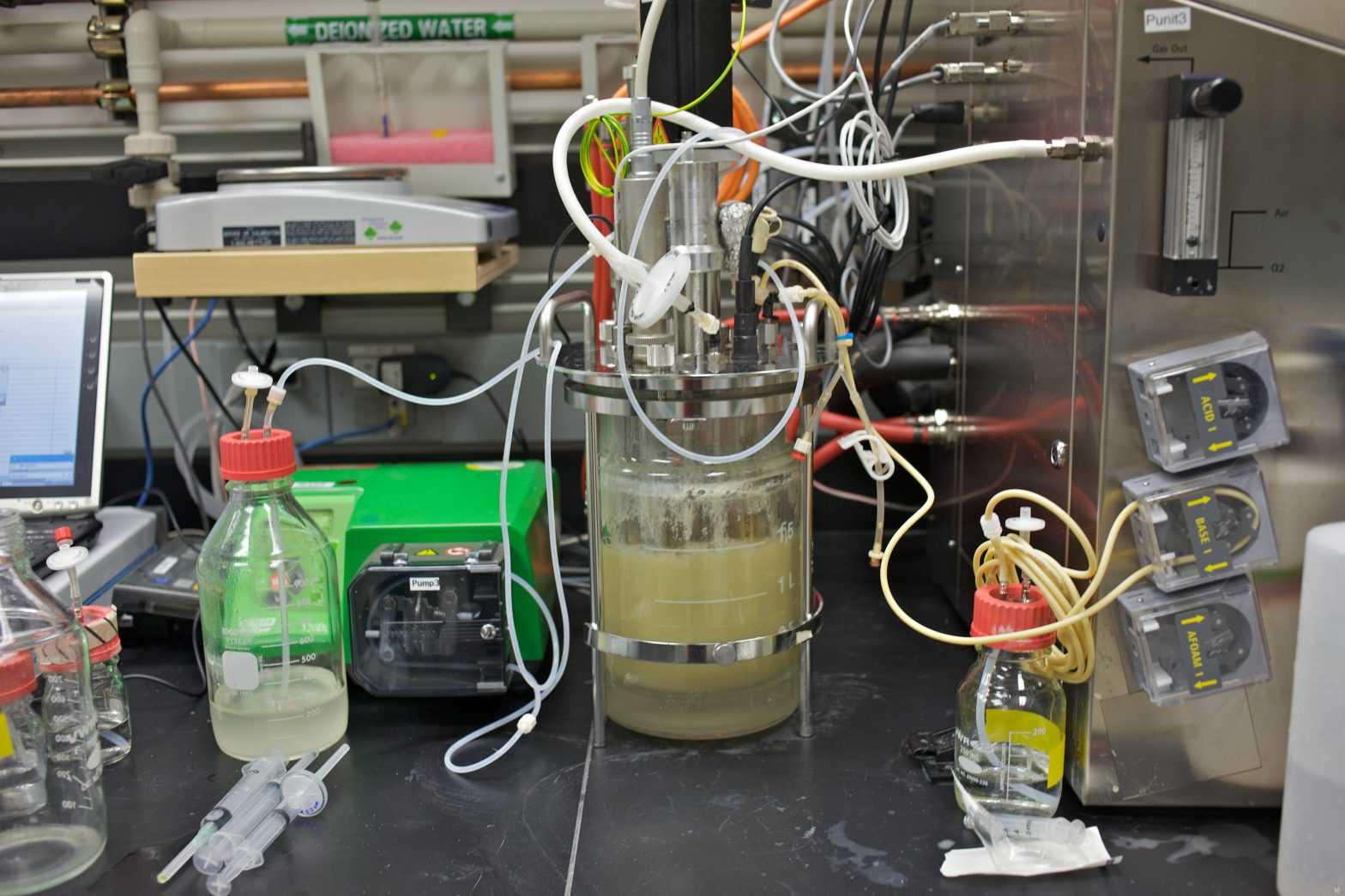

A team of local biotech researchers may have found a way to avoid using essential food crops for fuel by genetically modifying harmless strains of a bacteria most people associate with human food poisoning. The result is an extremely expensive fuel — hardly competitive with fossil fuels at $25 per gallon — but marks the beginning of a new look at green energy.